How to Use Your CRM to Host a Successful Networking Event

Dec 20, 2023Networking events are an important way to begin and enhance working relationships with both potential clients and referral partners.

As a mortgage professional, one of your biggest challenges is maintaining a steady pipeline of repeat customers. Loan officers are often too busy to keep up with the daily management of their client list. As a result, they lose countless clients almost routinely. Surefire CRM, which is widely regarded as the best CRM software for mortgage professionals (according to Capterra), was created to avoid this needless loss of business for mortgage lenders.

This article covers:

CRM stands for customer relationship management. This is a technology for centralizing and orchestrating records of interactions with a company’s prospects and customers.

Sounds simple right? The truth is that it’s more complex than it sounds. Beyond customer and communication notes, CRM software often includes marketing automation capabilities connected to prospect and customer contact records.

As a loan officer or mortgage professional, you probably have the general idea of what a mortgage CRM is and what it constitutes. Still, there are a number of additional functions that your mortgage CRM can and should supply.

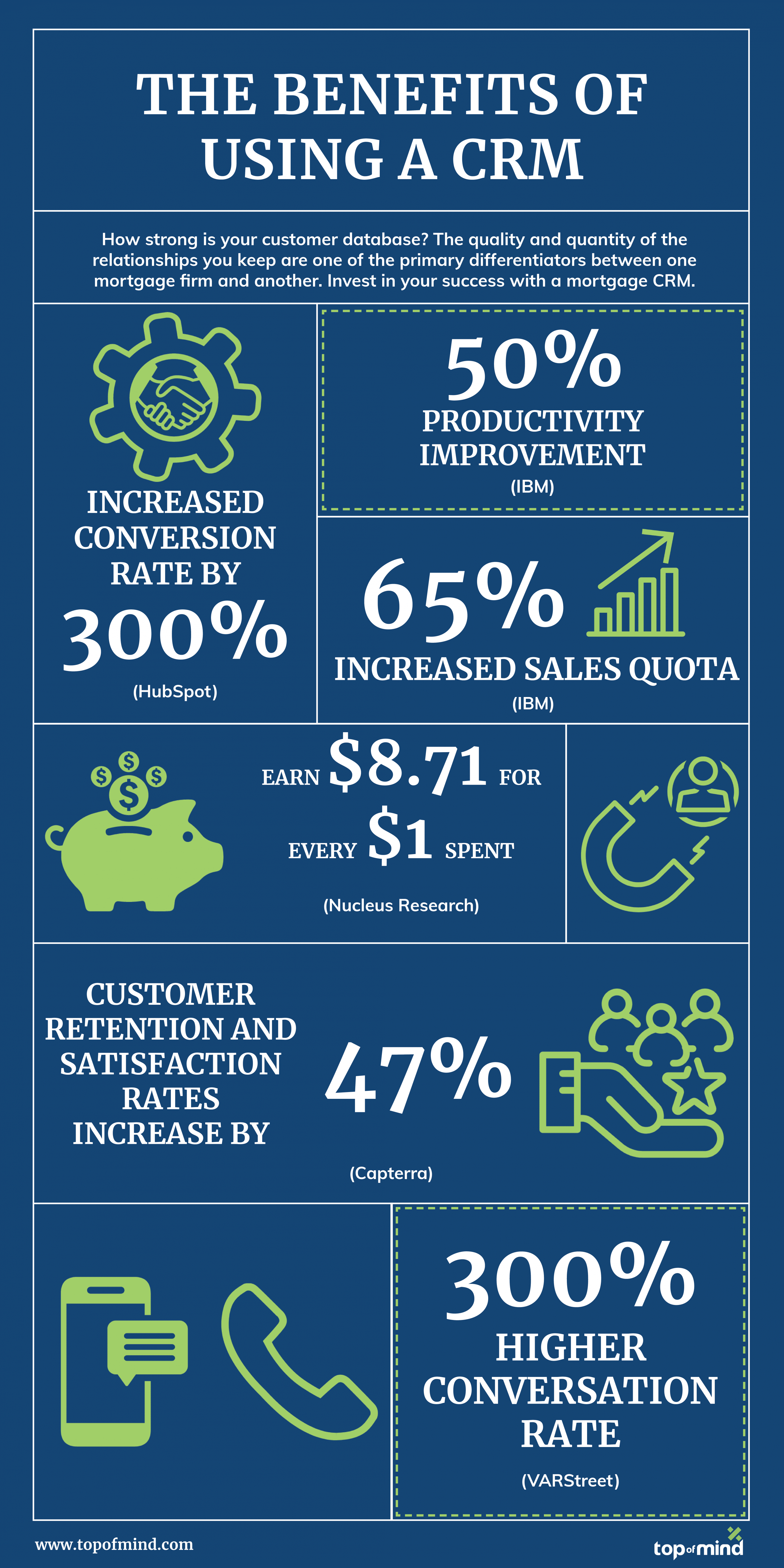

Yes, having a quality mortgage CRM is essential for your business. The bedrock of sustainable success in any business is the relationships between the business and its customers. Regarding the money lending industry, the quality and quantity of the relationships you are able to keep are one of the primary differentiators between one mortgage firm and another. There are a few questions to ask yourself to be able to judge the strength of your database at this time accurately.

Mortgage software gets a loan officer leads by form submissions and integrations. A mortgage software like Surefire CRM has lead capture forms built into it and the ability to accept leads from other websites such as Zillow. Quickly working on these leads is important once you get them, and mortgage CRM helps automate that immediate response.

Yes, having a quality mortgage CRM is essential for any lending professional. The bedrock of sustainable success in any business is the relationship between the company and its customers.

Regarding the money lending industry, the quality and quantity of the relationships you can keep are among the primary differentiators between one mortgage firm and another. There are a few questions to ask yourself to accurately judge your database’s strength at this time.

The best customer is a returning customer. Remarketing to current and past customers is a great method for generating a higher ROI with less cost to convert.

Data is everything in the world of business. In analyzing hard data, you can determine if you are making progress or the business is suffering. A company’s database should have all the records of the transactions made, the transactions’ date, and with whom the transactions were for. Relying on your ability to accurately monitor all this without the aid of a mortgage CRM software could help save you both time and money.

Trust is crucial, but when it comes to money business, it is beyond essential – if that’s possible. Most of the customers you are going to be working with as mortgage professionals have no prior experience in the business. For some of them, the loan they are seeking is the biggest financial move they have had to make. In that case, it takes a lot of trust for them to choose you over your competitors. It also takes a great impression and trust level for customers to come back to use your services. So, do your customers and partners trust you?

Everyone, if given the choice, would prefer to work with people they like. It is a human thing to do. It is common in every business, but in the money industry, it seems to be even more pertinent. A client who likes you and the way you handled your first business with them will return for your services. On the other hand, first-time borrowers are even more likely to purchase based on a superficial feeling. They are nervous and looking for familiar ground. So, if they like you, they will choose you.

If left to your discernment, you may not have accurate answers to the above questions. And that is where a good mortgage CRM software comes into play. As they say, numbers never lie! With a mortgage CRM software, you can easily provide answers to the above questions and much more.

The best way to find out what we offer is to try it out yourself. We’re confident that you’ll like what you see.

A CRM helps you build the strongest and most stable relationships with your clientele. Your customers will be pleased with your extreme attention to detail and amazed by your immense knowledge about their preferences if they have previously worked with you.

What’s more, it allows your mortgage processes to be seamless. With a CRM software, you don’t have to consistently task your brain to remember the tiniest details, making the experience remarkably easier.

You can track and manage the percentage of return customers for your business. This way, you can tell if your business is failing, why it is failing, and then you can set up measures to stem that tide. On the other hand, it can also show you if your business is doing well by displaying the percentage of return customers and purchasing frequency. So, you can step up those actions you are doing correctly.

With a mortgage CRM software, you don’t have to guess what’s going on with your business; you know exactly what is happening. Your business stands a better chance of survival and even thriving with such data.

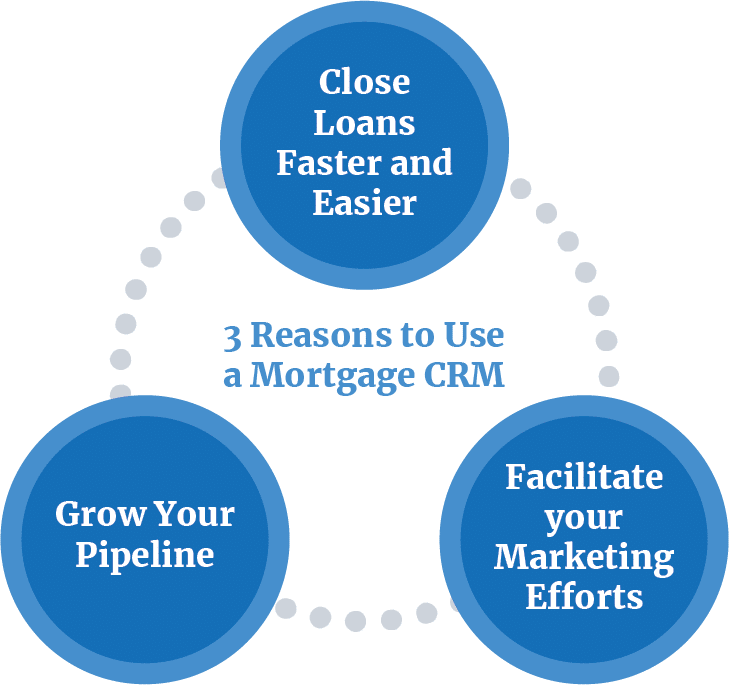

Perhaps the most important reason you need a CRM system is that you can close more deals and help your customers secure more loans. Of course, every business’s goal is profit, and the right mortgage CRM will ensure you close loans faster and with much less effort than your competition.

Another advantageous effect of using the right mortgage CRM is that your Realtors will demonstrate higher confidence in your business. You can notice this by the number of referrals they will bring to your business over time.

A good mortgage CRM software will satisfy all the below requirements:

Get instant access to tried-and-true mortgage marketing strategies and guides with Mortgage Marketing University.

See how Surefire effortlessly develops content tailored to your brand. Sign up for a free look book today.

You have what it takes to be a top mortgage lender and Surefire has what it takes to get you there. Learn How!

All CRMs aim to manage customer relationships. Therefore, they share certain features and similarities. They all track leads, manage your prospective and active customers and centralize your contact database so that your loan officers can manage their pipelines more efficiently.

Mortgage CRM software always begins with a base of contact records often described as leads. These leads are sourced from your social and professional network or through your website or third-party lead generation tools. Mortgage CRM software then engages these leads through mortgage-related workflows (such as in-process loan information) to drive your business goals. Through automation and key integrations, mortgage CRM helps you get more applications, close more loans and keep up with the borrowers long after the loan closes to start the cycle again with repeat and referral business. Advanced CRM systems like Surefire CRM employ advanced tactics such as multi-channel marketing and award-winning content has proven to generate more closed loans for lenders and help them compete.

Compliance in mortgage marketing is critical, and lenders and mortgage professionals must be up to date with the industry’s most recent compliance regulations and issues. To that end, you would find that many industry-specific marketing CRMs are equipped with integrated compliance modules. Some organizations make and enforce these regulations, such as FHA, HUD, and VA.

The best mortgage CRM should have the features that keep you updated on the latest changes in regulations by any of these agencies. These features ensure that no lines are crossed and that all the business operations align with the industry’s best practices.

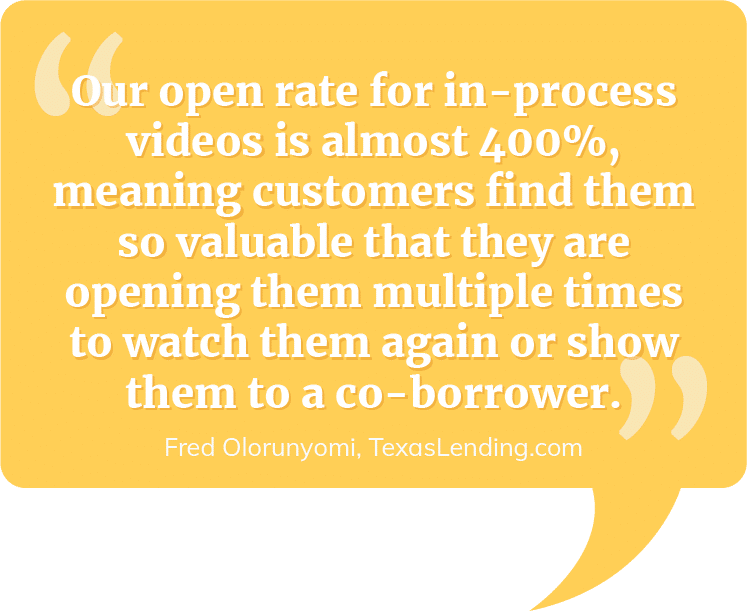

“Our open rate for in-process videos is almost 400%, meaning customers find them so valuable that they are opening them multiple times to watch them again or show them to a co-borrower.”

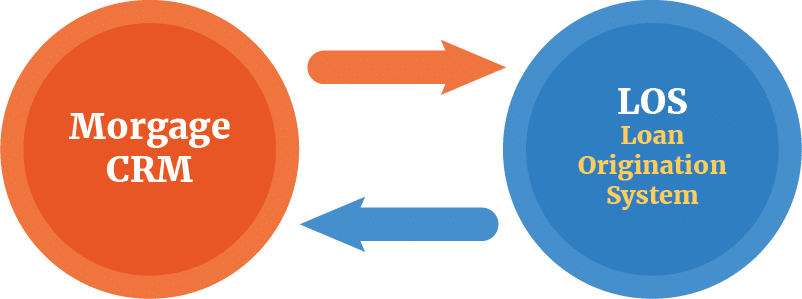

A Mortgage CRM can work with the LOS system to improve the management of your loan pipeline. Mortgage pipeline management is a crucial area where loan officers need help because it’s tough to handle on your own. A CRM makes it easy for a lender to view loan information, contact information, as well as emails and phone call history. You can also track loans at various stages of processing and view the various loan reports. What more? With a mortgage CRM, you can synchronize your most essential data, such as the 1003 application form and your loan status value.

Mortgage CRMs usually have tools that pop up alerts to inform the mortgage professional of upcoming events. These events could be happening within the company or the mortgage industry at large. For example, your CRM can remind you of which clients would need to refinance in the not-too-distant future.

Similarly, the best mortgage CRM would provide updates for you about application upgrades and the latest happenings in the industry. With this feature, you will be aware of changes in UFMIP and news about increased annual premiums.

Mortgage email marketing, otherwise known as drip marketing campaign is an integral part of marketing in the mortgage industry. The dedicated mortgage CRMs can send targeted messages to your referral partners and borrowers. These CRMs also monitor the campaigns so you can know your loyal partners, strengthen partnerships and figure out how to reward them.

With this feature, the real estate partners and borrowers you have worked with will routinely receive automated emails. This would ensure that, in a competitive market, you remain in the minds of your customers. Also, you would always have fresh mortgage marketing content to email your clients, you won’t forget to email and you would free up more time to prospect new leads.

Surefire CRM features a variety of different types of award-winning mortgage marketing content for all of your needs. Below is one of our most popular mortgage refinance calculators that our customers love. This same loan comparison calculator could be available directly on your site with just a few clicks.

To assess and evaluate the efficacy of your mortgage marketing CRM, you have first to understand the goal of having one in the first place. A good mortgage CRM software will satisfy the following requirements:

However, you can use certain general qualities or properties to judge if a CRM would be great for you and your company in the long term.

Indeed, you should be concerned about the CRM capabilities you choose to use for your business. This is especially necessary for analyzing the range or scale of price points and features of the CRM. You need to study the prospective CRM and understand what it means for your business.

Let us simply explain this: some CRMs are better suited for small business operations, while others are specifically created to handle businesses on a much larger scale. So, it is not unusual to find a CRM that does not have enough features to accommodate big companies. Likewise, you can also find CRMs with price ranges that cannot be scaled down to the level of small businesses.

However, the best mortgage CRM software should accommodate a broad spectrum of price ranges and features. It should factor in small businesses such as local mortgage lenders and the industry’s biggest money lenders. After all, it is these small firms and startups that eventually scale up and become industry giants.

Mortgage professionals trust Surefire CRM, from small broker teams to credit unions to sizeable independent mortgage bankers. It has possibly the broadest range of operation in the market. The good news is that you can quickly request a demo.

The moment you decide to join the mortgage industry is the best time to start looking for and start using mortgage software. Your LOS helps make sure your calculations are accurate. When set-up properly, your mortgage CRM will update your transaction log to keep you out of hot water with your state’s department of banking and finance. Furthermore, it will help you safely house the records you need for compliance. It will also store your clients’ and prospects’ contact information for future marketing and refinances.

After an LOS, the next step is tracking your leads and marketing to them with a mortgage CRM. Your initial book of business will come from your sphere of influence and expand from there. Keeping track of conversations, using the proper timing for sending communications and not letting things slip through the cracks is the easiest way to succeed. Once you have these in place, depending on your business’s volume, look for a Point of Sale (POS) system and a pricing engine to make repeated interactions easier with potential borrowers.

Now, here’s the thing: switching CRMs is much more than just changing a program or hardware in your company. Transitioning from one CRM to another can be tedious and very complicated. CRMs usually have steep learning curves and varying modes of operations.

Changing your software may require retraining your entire staff, improving your other systems, and most importantly, your mode of operation, which would detract from your productivity within that period.

So, you must pick a flexible mortgage CRM software that can adjust to your business’s future needs.

Mortgage email marketing, otherwise known as the drip marketing campaign, is an integral part of the mortgage industry’s marketing. The dedicated mortgage CRMs send targeted messages to your referral partners and borrowers. CRMs also monitor the campaigns so you can know your loyal partners, strengthen partnerships and figure out how to reward them.

With this feature, your partners and borrowers will routinely receive automated emails. This ensures that, in a competitive market, you remain in the minds of your customers. You would always have fresh mortgage marketing content to email your clients, you won’t forget to email, and you would free up more time to prospect new leads.

In our business, speed matters. Did you know 78% of customers buy from the company that responds to their inquiries first? That’s almost 4 of 5 leads, by simply responding first!

Surefire’s Power Messaging sets you up to win by instantly connecting you to your prospects. Zero downtime. Total focus.

Your prospects and clients demand instant availability. Give them what they want with Surefire’s Power Messaging.

Take it from VIP Mortgage Director of Marketing Cheri Booth, who now recommends Power Messaging as a best practice anytime an LO does a refi campaign. In Q2 of 2020, VIP Mortgage closed an average of 56% more loans per month compared to LOs at similarly-sized peers who hadn’t yet adopted Power Messaging.

Get instant access to tried-and-true mortgage marketing strategies and guides with Mortgage Marketing University.

See how Surefire effortlessly develops content tailored to your brand. Sign up for a free look book today.

You have what it takes to be a top mortgage lender and Surefire has what it takes to get you there. Learn How!

The average human doesn’t like stress and would do anything to avoid it. Having a CRM that would confuse your borrowers – who are already probably anxious about the loan they are seeking – would be counterproductive. One of the primary purposes of mortgage marketing CRM is to reduce stress. So, what good is a CRM that confuses and stresses out your customers?

Another thing you should consider is the time it takes to fully process one loan payment. If your system operates smoothly, you will close loans at a much faster rate. With a good CRM giving good and easy-to-follow prompts, your clients can quickly fill out forms and upload documents. Also, if it takes too long for a potential customer to understand your prompts and do the paperwork, they may decide to opt-out of using your services.

The bottom line is that if your CRM does not work seamlessly with your loan origination system, then there’s no need for a CRM. The entire purpose of a CRM is to facilitate mortgage lead generation, pipeline and help you close loans at an incredible pace.

For that to be done properly, it must be able to integrate with the LOS you have in place. Whether it is Mortgage Director, Calyx Path or Encompass – the major LOS providers available – the right CRM for you should be compatible with any of them.

User experience is simply how your borrowers feel about your business – what feelings they associate with your services. You provide a positive user experience if your customers enjoy working with you. On the other hand, if they feel like your system didn’t serve them in the best possible way, that’s a bad user experience.

It’s no secret that for your mortgage business to do well, the majority of your borrowers must enjoy working with you. Firstly, mortgages and money problems are stressful. Most of the clients that would come your way are already stressed about not making a mistake, the risks they are taking and could do without paperwork and complicated processes adding to their troubles.

The best mortgage CRMs expedite loan processes by providing a user-friendly interface. For this to be effective, however, there has to be a synergy between your LOS system and CRM. The mortgage CRM of your choice should afford your borrowers the ability to e-sign easily, without stress and complications.

The answer is yes. User experience keeps you in business. In fact, you would be in business only a little longer than when you stop producing a positive user experience.

On the contrary, if you have very positive ratings from your customers and partners, it becomes easier to convert prospects. The right mortgage CRM for you is the one that can achieve the best possible ratings in terms of service to your customers.

The best mortgage CRM is able to automate a lot of its communication to maintain a good relationship with your customers and partners. Simply put, a good mortgage CRM is a more reliable follow-up option because the possibility of forgetting to follow up is completely out of the question. The CRM automates many emails that would be sent to the borrower or your realtors.

With CRM, you can celebrate with your partners and customers on their birthdays, anniversaries or other special events. These emails can be customized for a more personal touch – and for an important customer – or it can be generic, with only the name of the recipient being the difference.

Interested in seeing what our award-winning content looks like? Sign up for the free content tour!

Without communication, there is no relationship. Whether in the area of lead generation, prospecting or pipeline building, mortgage professionals need to be in touch with their real estate agents and customers. Just by being in touch, you significantly increase your chances of earning clients for life. Most borrowers would prefer to work with a professional they had used in the past but end up losing touch due to poor follow-up.

Sending automated messages on important occasions like birthdays and anniversaries goes a long way to endear you to your customers. For your realtors and partners, an email reminding them of how together, you closed a major loan and how incredible they were throughout the process, could propel you into becoming their favorite.

The best mortgage CRM also provides closing gifts that you can personalize for your clients. Closing gifts, such as cutting boards, serve as constant reminders of the awesome service you provided, keeping you top of mind with past borrowers.

You would build strong bonds, which would, in turn, affect the frequency with which your customers return to use your service.

After considering the general qualities of CRM software, it is time to get down to the specifics. Because what good is a system that is highly rated but won’t be the right fit for your business? With that in mind, here are a few things you should consider before you decide on the best mortgage CRM software for you:

What would be your preference in terms of how you want to host the software? Do you plan to host it on the cloud or locally on your servers?

Using cloud hosting services gives you the ability to access the data more easily while also working as a backup in case of emergency but will also require additional security measures.

Does the mortgage system you are shooting for work well with the other systems you have in place?

You need to consider software that suits your existing legacy systems such as your accounting and ERP systems.

The right CRM should provide base functions for generating leads, sending out communications, and creating reports. The right CRM will also have customizable features that meet your company-specific needs.

May we reiterate once more that the best mortgage CRM for you is the one that seamlessly optimizes your operation and not the one that is the rave of the moment. You can sign up for a demo free of charge to see if we are the best fit for you.

The best thing you can do for your mortgage business is to incorporate a dedicated mortgage CRM. Not a regular CRM, like the type used for other companies, as that can be counterproductive, but a mortgage CRM.

Understand that when you are shopping for a CRM, it is for the long run. So, endeavor to get yourself a flexible mortgage CRM that can scale up or down, depending on how business is going. Of course, you may want to try out Surefire; it has the best possible scalability.

Surefire mortgage CRM has unique offerings that set us apart from most other CRM’s out there. Our mortgage marketing plans include mortgage social media marketing, mortgage landing pages, and mortgage marketing flyers, among others.

A great mortgage CRM helps you keep in touch with your clients, leads and business partners. It has the necessary specialized features for compliance and regulations that affect the mortgage industry. Surefire CRM has smart marketing automation and the tools mortgage professionals need to stay compliant.

Loan officers use many tools for marketing themselves. They collect leads using online forms where prospects can request more information. Mortgage advisors also keep in touch with their past clients using CRM automation through email, text, postal mail and phone calls. They are expert networkers and are active in their communities through the chamber of commerce and charity work.

A loan origination system (known as an LOS in the mortgage industry) is the centerpiece of the lenders’ loan origination process. The LOS is the central technology hub for all of the staff involved with loan origination, including loan officers, underwriters, loan officer assistants (LOAs), processors, funders, and more. It tracks and drives borrowers through the key stages of the origination process, including pre-qualification, loan application, processing, underwriting, credit decision, quality control, and funding. Modern systems have an increased focus on fraud detection, scalability, data security, automated decision-making, and compliance-related reporting and tools.

The most basic marketing tools are the communication devices used across all industries, the phone, email, and text messaging. Orchestrating the actions around these tools is done by a mortgage CRM, which is one of the first marketing investments made by successful loan officers. Social media, including platforms like Facebook, LinkedIn and more, require connectivity and a constant stream of creative content, often provided by the mortgage CRM. Advanced marketing tools include sourcing leads from third parties (like Zillow or Lendingtree) or even marketing using billboards, television, or online ads. These ads require an incoming lead management platform (sometimes dedicated, other times part of the mortgage CRM). For conversations and market conditions, loan officers need strong consultative tools like Mortgage Coach and MBS Highway to produce timely insights that can generate productive outbound conversations while you market your business.

Get instant access to tried-and-true mortgage marketing strategies and guides with Mortgage Marketing University.

See how Surefire effortlessly develops content tailored to your brand. Sign up for a free look book today.

You have what it takes to be a top mortgage lender and Surefire has what it takes to get you there. Learn How!

Networking events are an important way to begin and enhance working relationships with both potential clients and referral partners.

Ad conversion rate measurement helps LOs gauge the effectiveness of their marketing spend. Surefire mortgage CRM can boost those metrics.

Credit union marketing strategies can benefit significantly if marketers utilize content designed from the start to foster engagement.

Connect with Top of Mind on Social Media

Our team is on the cutting edge of news, information and technology in the mortgage industry. Connect with us to stay up to date on the latest mortgage news and information.