There are six components for an effective credit union mortgage marketing strategy.

1.) New Member Acquisition

Credit unions appeal to borrowers with a member-centric model. As a result, the communication process between credit unions and their members needs to be timely and personal. The challenge that all credit unions face is the growth of this personal service at scale.

The member acquisition process blends customer service and marketing elements gathering information about prospective members to understand their needs and the products and services that offer the best solutions.

By implementing different marketing tools such as landing pages and SMS texting, credit unions can automate and streamline this process leading to growth at scale.

2.) Landing Pages

Savvy and successful financial marketers create campaigns that send leads and foot traffic to landing pages. Different from the institution’s home page, landing pages should draw a clear path of action for leads. With any landing page strategy, you must measure lead and inbound foot traffic. Set key performance indicators and adjust your landing page to achieve the best results.

A call to action is the most essential component of a landing page. Entice leads with a free quote, consultation with a specialist, webinar, etc. Click here for a list of elements that make up an effective mortgage landing page.

According to a recent survey by Renderforest, videos on landing pages increase conversions by up to 86%. The video should be educational and informative for the lead, and you’ll get bonus points if it’s personalized to your brand. Immediately add a face and personality to your brand with a short greeting that introduces your credit union and encourages prospects to fill out the form.

Another way to keep leads on your landing page is to add a mortgage calculator that can be configured by the prospective member. It’s both a valuable tool for the lead and a way for you to gather important information that could help to turn them into a member.

For more information on how to build a landing page that converts, click here.

3.) Email Marketing

Email marketing allows credit unions to educate and build trust with future and prospective members. Although it’s the oldest digital marketing medium, email still positively contributes to ROI for 73% of companies in the financial industry, according to Econsultancy.

It’s important for credit unions to shape email campaigns in a way that targets member audiences personally, involving them in the conversation and keeping your services top of mind. A great way to engage your target audience is through email is with video.

Create educational videos that establish your institution as a trusted subject matter expert. For first-time homebuyers, send videos that coach them on building their credit score and the do’s and don’ts of the loan process. For experienced homebuyers, they’ll need a refresher course on what to expect during the loan process and what they need to do to prepare. However, these videos need to go to the correct member types to be effective.

Customer segmentation of your contacts is crucial to effective mortgage email marketing. According to MailChimp, users who segmented their contacts into email lists received 14% more opens and 15% more clicks than the list average.

Credit unions should be keeping a very detailed record of their contacts and properly segmenting each type for appropriate messaging. Sending emails to check in on abandoned loan applications drastically improves closed loan volume for credit unions.

Another way credit unions can benefit from customer segmentation lists is through post-close follow-ups, such as a nice note on the anniversary of their closing or wishing them well on their birthday. Small and intentional touches like these keep credit unions at the top of members’ minds for the next time they need financial services.

4.) Social Media Marketing

Studies show that 78% of salespeople who use mortgage social media marketing out-perform their peers. So in a world of mindless scrolling and information overload, how can credit unions use social media marketing to stand out and build their brand?

Connecting with prospective members on every social media channel is a great starting point for credit unions. Of course, your entire audience won’t be on a single platform, and you’ll want to maintain profiles on as many sites as you can to get in front of every age group.

Social media is an avenue that can help credit unions build brand recognition within their own community and with the option to invite current members to groups, it creates a direct path to interact with their current member roster.

However, an omnichannel presence on social media will only get you so far. Credit unions should post with a cadence and a purpose on social media to drive awareness and growth.

Here are some topic suggestions:

-

- Product announcements

- Local branch news

- Member testimonials

- Answer questions

- Provide solutions to common problems

Posting with a purpose-driven strategy builds brand authenticity and shows followers that the company is community-driven. With any mortgage social media marketing strategy, consistency is key to building loyal followers and an engaged audience.

The type of content you post on social media matters, too. The same study from Renderforest found that video is the most preferred content type on social media and that 75% of people are more likely to follow a brand’s social media page if it has video content.

Videos add an extra level of authenticity for credit unions to showcase their unique differentiators in the marketplace. Plus, borrowers can picture what it would be like to become a member.

5.) Compliance

Regardless of their non-profit status, credit unions must abide by the same marketing compliance standards as any other lending institution and the same fines for non-compliance.

When credit unions attempt to grow through the use of marketing automation, it can be easy to forget the fact that all communication will need proper compliance review. Luckily, there are methods to streamline this process with compliance technology:

-

- Centralized communication

With marketing automation, emails, text messages, and social media marketing messages are now all in one place. So you don’t have to worry about that one rogue LO sending unapproved messages.

-

- Approved content at your fingertips

Strong mortgage-centered marketing automation systems like Surefire will include content that adheres to compliance standards. If a loan officer decides to customize the content, marketing managers can review the piece of collateral and make adjustments, if necessary.

Robust mortgage-centered systems will offer credit union lenders the ability to pull commonly requested audit reports. Then, when compliance officers need more details, strong CRM companies will have team members ready to assist.

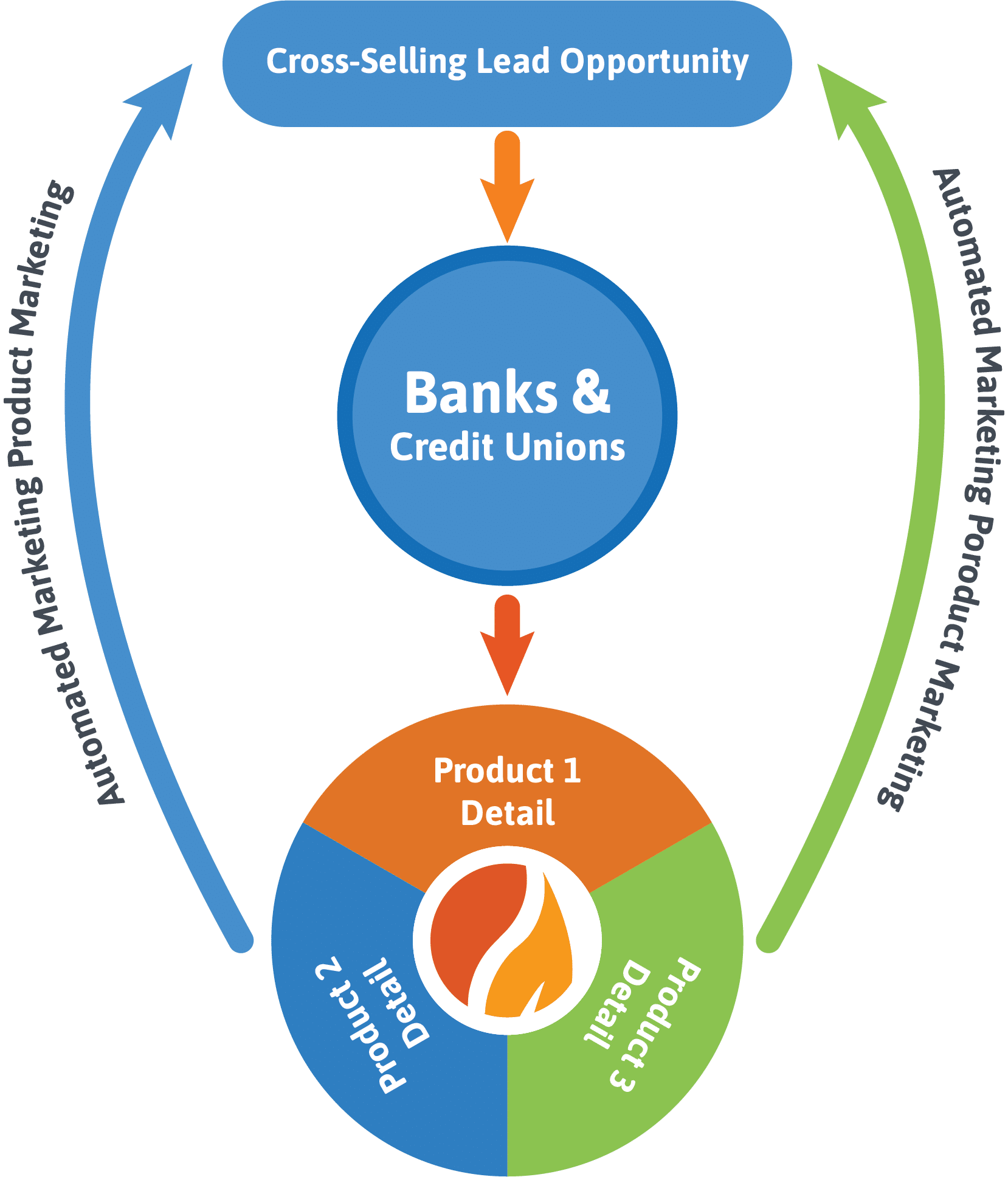

6.) Marketing Automation

A personalized experience is no longer an option in the credit union space, it’s a necessity. From digital touchpoints that help members streamline their finances, triggered email communications based on changes to members current status, to providing exceptional customer service marketers can strengthen the member experience through email, text, social media posts, and even phone calls in a way that feels friendly and personal.

Marketing automation builds brand trust, enabling credit unions to place members on engaging and educational tracks with a simple click.

Plus, credit unions discover more deals with marketing automation. If your lists of contacts have become unwieldy, you’re in the right place. Surefire, the most-used mortgage CRM, helps credit unions identify new loan and retention opportunities within their existing database.

Surefire identifies and deploys rate, equity, and just listed alerts, so you never have to miss an opportunity again. In addition, Surefire sends off award-winning content with set-it-and-forget-it functionality when an alert arises, which is the key to winning repeat business before your competitors beat you to the punch.