How to Use Your CRM to Host a Successful Networking Event

Dec 20, 2023Networking events are an important way to begin and enhance working relationships with both potential clients and referral partners.

Success for any mortgage lender happens through marketing automation, ensuring every loan stays on a clear path to close. Marketing automation offers a solution to mortgage professionals to scale their engagement with prospects and customers, continually track and optimize their performance, and even integrate with artificial intelligence to automate communication. The result is precious time given back to loan originators.

This Article Covers:

Marketing automation uses technology to manage and automate many different mortgage marketing processes and procedures across multiple channels.

By implementing marketing automation, mortgage lenders can develop custom communications for both prospective and current customers in many formats, including calls, emails, text messages, social media, and the web. These communications can be personalized based on the information contained in your mortgage CRM.

Every member of a loan origination team can benefit from using marketing automation, from loan officers to compliance managers, as automation creates a method to optimize marketing and sales activities in a way that administrators can approve and track.

Marketing automation works by creating a series of communications based on the typical actions a customer or prospect might take when interacting with your company.

As a mortgage marketing professional, a crucial step for planning your marketing automation strategy is to ensure that you understand the messaging for each step of the customer’s journey.

Whether your customer is in the stages of a necessary credit repair or considering the opportunity to refinance their current mortgage at a lower rate, your messaging needs to speak to their unique situation.

Human involvement is also a critical component of automating your mortgage marketing process. When a customer needs a call, it is essential that your workflow triggers a task to the loan officer or loan officer’s assistant to follow up personally.

Although many marketing professionals use the term workflow and campaign as if they were the same, a marketing workflow is a unique function of the marketing automation process. Marketing workflows act as a road map for your leads, creating an automated set of actions. Your leads are set sent down individual paths of the roadmap using the logic of “if this, then that” triggered by the information a customer submits or the marketing content they interact with.

Marketing workflows operate based on the rules you set for any leads. When marketing mortgages, rule-based workflows are critical components for creating a long-term relationship with your customers

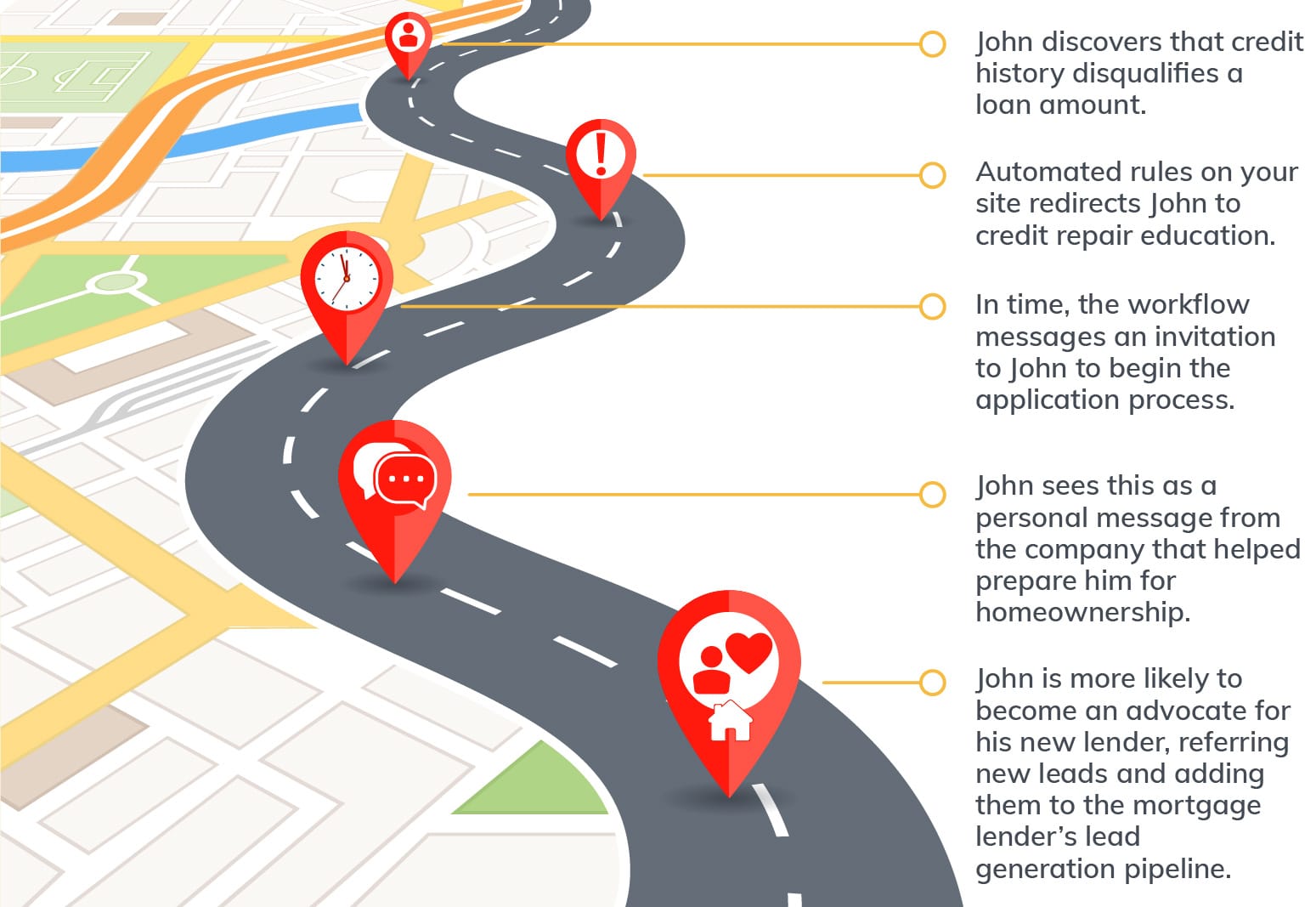

As an example:

A Prospective customer John Smith enters your site looking for approval on their first home purchase.

During John’s customer journey, it is discovered that his credit disqualifies him from the loan he wishes to obtain. The workflow rules should trigger a conversation regarding possible alternatives such as FHA financing if practical, and if not, then reroute John to a different avenue of the customer journey from the loan application phase to educating him on how to repair his credit.

After the necessary time elapses for John to repair his credit, your workflow should trigger a message to John inviting him to begin the application process.

John doesn’t see the invitation as an automated communication but a personal message from the company that helped him prepare for homeownership. As a result, John is more likely to become a crusader for his new lender, referring new leads and adding them to the mortgage lender’s lead generation pipeline.

The purpose of using workflows goes far beyond reaching simple lead generation metrics. If you work to understand and improve your customer experience, mortgage marketing workflows can work as a strong advocate for your brand while ensuring that you meet your revenue goals.

In the new age of technology, there is very little of the mortgage process that would not benefit from internal and external communications automation — however, the more complex your workflows, the more time and capital you may need to commit.

For any mortgage lender looking to take a more general approach to market automation, there are five types of workflows that can optimize production.

Inbound lead workflows

As the name implies, this type of workflow is about attracting new leads to your lending organization. Generating these leads comes from engaging them with some form of marketing content to submit information about themselves and their financial goals.

Most mortgage marketing professionals use different content types, including Interactive mortgage calculators, funny mortgage memes, or a new interest rate report, to prompt the initial interaction, thereby creating a unique contact record within their CRM to house the new lead’s information.

But this workflow type shouldn’t end as soon as your new lead submits their contact information. Other interactions through email, text, mail, or a phone call may be needed to determine if the lead should upgrade to a prospect.

Nurture workflows

These workflows help to guide prospective borrowers to the application process. Until the prospect upgrades to an applicant, most of the communication in this workflow needs to be centered on hypothetical scenarios, as critical pieces of information will not be known until the prospective borrower completes the application process.

As a bonus, nurture workflows can also be applied to existing clients and referral partners, helping to build and strengthen relationships.

In-process workflows

These workflows aim to help close loans in the most efficient way possible, deploying customized communications through integrations with different systems such as your LOS and PPE software when specific goals are met or not met.

These workflows also help simplify the process for your borrowers, ensuring that they are educated at each step of their journey.

Re-engagement workflows

Not every prospective borrower makes it through a workflow on their first go around. Regardless of the reason, re-engagement workflows are designed to get prospects and clients back on track.

Post-close workflows

Many mortgage professionals don’t realize that the clear to close is not the end of the mortgage marketing process. It is just the beginning. Post-close workflows allow you to capitalize on your previous customers by triggering communications when they meet certain milestones or anniversaries, ensuring that they remain clients for life.

Rule number one for successfully implementing mortgage marketing automation is to know your audience. Workflows need to be designed for the people they serve in any event, be it an internal or external process.

As you work through the steps that the contact takes, be sure you consider what they might do. A workflow can always have another branch, so make sure you think of the different actions a contact can take at each step and build accordingly.

Another great rule to follow when developing your marketing automation process is to remember to test and update. No process is perfect on the first go, and there is always room for improvement. So review your stats frequently and adjust accordingly.

Working with a system that is made specifically for mortgage lenders is a great start. But for those looking to weigh their different options, here are three functions that you need in any mortgage marketing automation tool.

Integration with your other systems

Communication is the key to excellent marketing automation, so it is essential that any system you choose needs to work with any of the loan software you use in the loan origination process.

This should include your loan origination system, your product pricing engine, and even your point of sale software. These systems need to communicate with your mortgage marketing automation platform to keep the origination process moving efficiently.

Administrative approval and review

For any team size greater than one, you’ll need a review function that both allows you to ensure mortgage marketing compliance and also allows you to track the status of any customer, employee, or referral partner in your database.

Templated content and workflows

Starting from zero is never easy. This is why any system you choose needs to come equipped with templated workflows and content tailored to your business needs.

The best thing you can do when implementing a mortgage marketing automation strategy for your mortgage business is to build your processes with the end goal in mind.

If you want to stay ahead of the game, you’ll want to start with a flexible mortgage CRM that can scale up or down, depending on the business cycle.

Surefire CRM has unique offerings that set us apart from other CRM’s out there. Our mortgage marketing plans include rule-based workflows that will work with your internal staff, current and past customers, and referral partners all in one platform. Surefire also offers numerous integrations with different systems essential to your business, ensuring that no communication is ever missed.

Get instant access to tried-and-true mortgage marketing strategies and guides with Mortgage Marketing University.

See how Surefire effortlessly develops content tailored to your brand. Sign up for a free look book today.

You have what it takes to be a top mortgage lender and Surefire has what it takes to get you there. Learn How!

Networking events are an important way to begin and enhance working relationships with both potential clients and referral partners.

Ad conversion rate measurement helps LOs gauge the effectiveness of their marketing spend. Surefire mortgage CRM can boost those metrics.

Credit union marketing strategies can benefit significantly if marketers utilize content designed from the start to foster engagement.