How to Use Your CRM to Host a Successful Networking Event

Dec 20, 2023Networking events are an important way to begin and enhance working relationships with both potential clients and referral partners.

If you are a loan originator, mortgage lead generation is at the forefront of everything you do. We often think of leads as brand-new borrowers. As your business grows, the leads will come more regularly in the form of repeat business and referrals from happy clients. Either way, you are always on the lookout for deals to fill out next quarter’s pipeline.

In your Complete Guide to Mortgage Lead Generation, we’ll talk about different methods for gathering and capturing leads. Read on for new ideas and twists on the traditional ways of lead capture that may surprise you.

This Article Covers:

While it’s tempting to identify potential customers by purchasing lists from lead companies, proceed with caution. In fact, you may save money and hassle by skipping purchased leads altogether.

Be especially wary of large or free lists. Many CRM platforms — mortgage or generic — either do not allow or strongly discourage the upload of these types of lists. If you market to them, you are likely to receive spam reports and, in some cases, could even have your server blacklisted by email clients. You can go from having an influx of potential customers to not being able to contact any prospects at all after one failed email.

If you do successfully connect with leads from this type of list, they are also likely to be high in the sales funnel. They may require months of nurturing before they move to prospect or borrower status.

Should you consider exclusive leads? These are more likely to transition successfully into borrowers since the information is typically shared with only one or a few LOs. Records of exclusive leads typically come with details that enable better marketing, such as the type of financing they seek, their timeframe for making a move, or their credit worthiness.

While exclusive leads can be relatively expensive – $100 or more each – they also are more likely to make it to a closing. Plus, CRMs are more welcoming of exclusive leads. Surefire CRM has partnerships that enable the integration of exclusive leads into the platform, allowing for easy tracking, management and marketing.

The best leads are likely to be those who come to you — not those you go after. And how do you get them to come to you? You go after them first, of course!

Consumer-direct mortgage originators put themselves out into the world as an expert, the borrowers whose interests, experience, location, and desires most align with your business will see you as the person who MUST write their loan. So yes, you go to them, then they come to you.

We’re going to talk about four primary ways to create direct mortgage lead generation: online content, retargeting existing clients, print marketing, and personal networking.

The best way to find out what we offer is to try it out yourself. We’re confident that you’ll like what you see.

If you pay for a coaching program hosted by billion-dollar originators, you’ll likely get advice on establishing an online presence to generate leads. You’ll be encouraged to identify your niche (or a few areas of expertise), then develop educational content around that topic.

Maybe you’ll host a live video on YouTube each week, then promote it on Instagram and Facebook. You’ll likely be encouraged to develop downloadable materials, which you’ll provide in exchange for a prospect’s email address.

These billion-dollar originators are not wrong. But is there a better way?

That’s where you can combine the coaching advice of experienced loan officers with the tried and tested content of your favorite mortgage CRM.

Choose your niche, which should be something important to your community of potential borrowers. For example, if you’re located near a military base, you may want to select VA loans as one of your areas of expertise. If you’re in a high-priced area, you might look for information on jumbo loans or trade up buyers.

Review the information in your CRM that applies both directly and indirectly to your niche. For example, you might search for info on VA loans and also for moving from renting to buying or first-time buyer options. Edit the content as necessary to fit your audience and your niche.

You now will have weeks of content ready to go. You can repurpose the messaging to record videos, or you can distribute directly through social media channels.

Remember to provide viewers a way to get in touch with you. The easiest way will be to send them to a landing page related to your topic. Include a contact form that will allow them to reach out quickly. Results can feed directly into your mortgage CRM and trigger an automated response.

As your business grows, remembering every deal becomes more difficult, if not impossible. A strong mortgage CRM will continually monitor your database to identify leads and help you retarget existing contacts.

Three common opportunities to identify include:

In the case of the rate alerts, you can reach out to your client to tell them about their refi opportunity. In the other cases, you can reach out to offer your services and recapture the client. One Surefire CRM user notes that the Just Listed alerts specifically have helped recapture business from clients who didn’t realize their company could help with out-of-state moves.

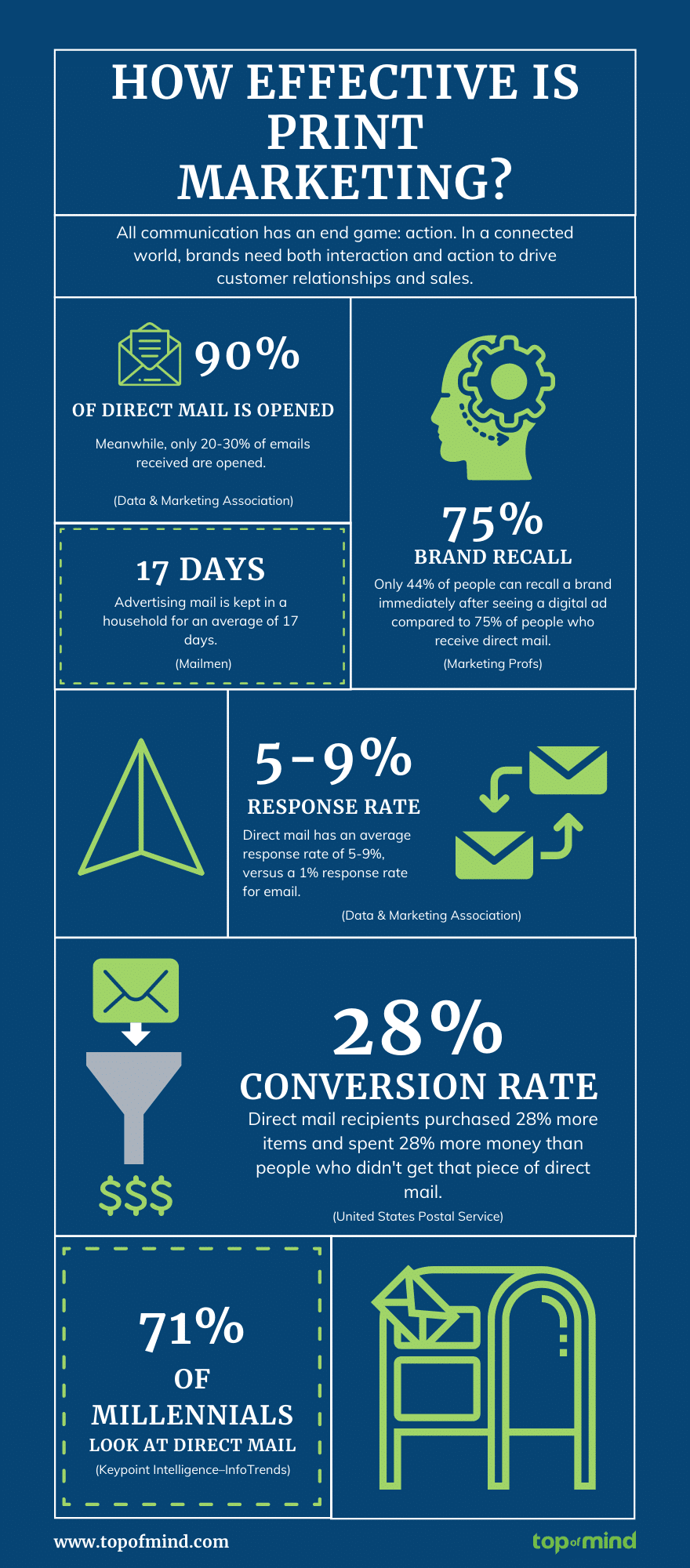

While direct mail may feel passé, studies show it’s still an effective and cost-efficient method of mortgage marketing and mortgage lead generation.

Recipients of direct mail open about 90% of the pieces they receive, versus only 20-30% of emails received. They remember direct mail too. Only 44% of recipients remember the company that sent a digital ad, while 75% recall the brand that visited their mailbox.

And perhaps the most important statistic – direct mail garners a 5-9% response rate, while emails get only a 1% response rate.

Numerous options exist for generating mortgage leads through print marketing. With the help of a mortgage CRM, you can segment your database to send targeted messages. For example, past clients will appreciate receiving information on refinance or HELOC opportunities from a trusted advisor, while prospective buyers might like a quick reminder of low downpayment options.

You might also segment your database into groups based on age. For example, clients 62 and older might appreciate information on reverse mortgages, as might clients in the “sandwich generation,” who may be looking after their parents’ affairs.

If you collect career information, you might send first responders, medical professionals or teachers information on special offers for their professions.

Referral partners might also be willing to share address lists for sending targeted information, such as recent sales, open houses, or special educational sessions.

Direct mail can be especially useful for mortgage lead generation when you take a multichannel marketing approach. Consider including a QR code link and/or the address of a unique landing page to provide more information and collect the recipient’s contact information.

Referral leads come from two primary sources—referral partners and past clients.

The most common referral partner for loan originators and mortgage bankers is a real estate agent, and many loan officers establish their pipelines with the help of just a few good agents.

The best way to build a referral relationship with a real estate agent is to deliver on time, every time, and to communicate clearly through the process.

In-process marketing materials from a strong mortgage CRM like Surefire will deploy automatically based on loan process triggers you set up. These allow you to keep borrowers and deal team members updated and informed of next steps without any extra work. By including all deal team members — not just those you already work with – you can expand your reach.

Here are some more tried-and-true methods to help you build relationships with referral partners:

Real estate agents may express concerns about value sharing to meet RESPA requirements. While strategies for meeting these rules vary across companies, you should be prepared to enter the discussion. A strong mortgage CRM like Surefire CRM will offer options for value sharing.

When building referral partner relationships, expand beyond real estate agents. Financial planners, CPAs, insurance agents, and lawyers are among the other professionals that may bring value as referral partners. Learn their specialties and areas of interest. Then, as you’re bringing in leads, be prepared to answer prospect requests regarding other financial professionals.

Collecting leads when you’re out and about in your daily life should be quick and easy. With a mortgage CRM like Surefire, it is. Assets like forms and calculators are optimized for mobile use. When you meet someone who’s interested in a loan, it’s easy to collect their information from your mobile device.

These leads will go directly into your database, triggering an immediate response. They can also trigger an appropriate prospect workflow, without your having to remember to do anything when you get back to the office.

Gathering leads is not enough. You’ve got to do something with them, too. A strong mortgage CRM like Surefire can help your company take leads all the way through closing with tools such as:

Surefire CRM can help you get the leads, nurture them, walk them through closing and keep them for life. Schedule a demo and let us show you how.

Get instant access to tried-and-true mortgage marketing strategies and guides with Mortgage Marketing University.

See how Surefire effortlessly develops content tailored to your brand. Sign up for a free look book today.

You have what it takes to be a top mortgage lender and Surefire has what it takes to get you there. Learn How!

Networking events are an important way to begin and enhance working relationships with both potential clients and referral partners.

Ad conversion rate measurement helps LOs gauge the effectiveness of their marketing spend. Surefire mortgage CRM can boost those metrics.

Credit union marketing strategies can benefit significantly if marketers utilize content designed from the start to foster engagement.