No system, no matter how great, can do everything.

Although many software providers promise to be the ONE system that will automate every function of your business so that you can spend less time in the office and more time on sandy beaches in exotic locations, the fact is that no system can perfectly run every facet of your business.

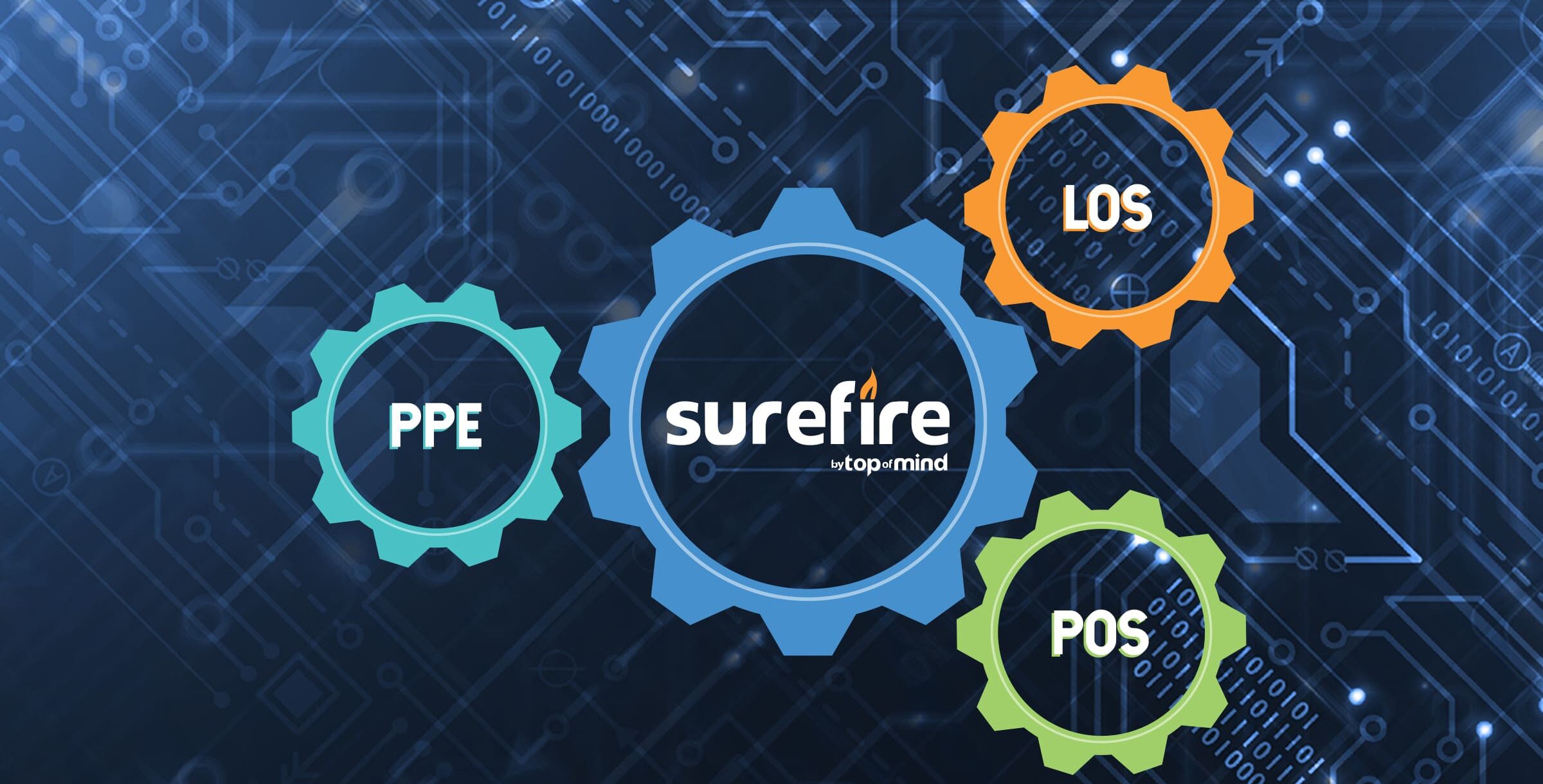

The mortgage industry is no exception. To operate as a lender, you need multiple systems working with one another to automate, simplify and expedite each step of the lending process.

To get to this seamless and tightly integrated state, it’s critical that you select systems that have been specifically designed for use by the mortgage industry. In other words, the software solutions will have been designed to support the many steps of the loan process and work together like runners passing a baton forward in a relay.

An Integrated Workflow

The start of the loan process begins with the borrower filling out an application. A point-of-sale system (POS) provides a web-based access point for your borrowers to launch and interact with your loan application. Ideally, your application is easy to fill out and will let users save their progress, upload documents securely, or even save and continue inputting their information from another mobile device.

Once the borrower’s information has been submitted from the application, the borrower needs to be presented with different lending options. For this to work, the POS will need to share the information with a product pricing engine (PPE). A product pricing engine generates the different loan pricing scenarios and varying rates that the lender can offer based on the borrower’s qualifications.

In a perfect world, the borrower applying for the loan will immediately qualify and begin submitting the offer for their dream home. But, there are some who will not qualify during their first application. This is where your mortgage CRM can swoop in and save the day.

Through different educational campaigns, your CRM can help you remain top of mind with your client as they improve their creditworthiness and are prompted through targeted messaging to return to the lending platform.

Once the borrower qualifies and starts the process of purchasing the home, the lender’s loan origination system (LOS) takes the lead in the origination and processing of the loan supported by the mortgage CRM and POS software.

Improving Your Workflow

From underwriting through the appraisal process, all the way to the close, these systems work together to produce the information necessary for the borrower’s loan approval, and the more seamless the integration, the better the experience for the borrower.

Although we’ve given a simplified version of the loan process in this post, we know that loan origination and approval is complicated.

However, there is no software provider that can excel in the entirety of the mortgage process. Luckily, Surefire℠ CRM and Mortgage Marketing Engine and its integration partners work together to create a way for the systems to “talk” to one another and keep the loan moving forward.

If you’d like to see how Surefire CRM can provide new innovations to your current tech stack, schedule a demo today.