How to Use Your CRM to Host a Successful Networking Event

Dec 20, 2023Networking events are an important way to begin and enhance working relationships with both potential clients and referral partners.

In a world where digital marketing is everywhere, mortgage lenders still need printed mortgage marketing materials in their omnichannel marketing strategy. In fact, the Association of National Advertisers found that direct mail had an 8% higher response rate than email. That’s because we don’t get nearly as much junk in our mailboxes than our inboxes.

Still, that doesn’t mean that you should only stick to direct mail because everyone else is overutilizing email. The best mortgage marketing strategy uses an omnichannel approach, meaning that a automated marketing campaign uses an array of channels to reach borrowers. One study found that marketing strategies that used direct mail with another digital media saw an 118% increase in responses, versus using direct mail by itself. It is best practice to add these components to your mortgage marketing mix:

Keep in mind that direct mail isn’t effective unless it is personalized. People are much more likely to respond to mail that feels like it’s written specifically for them. A recent study found that the combination of a person’s full name, full color, and sophisticated data on the card can increase the response rate by up to 500%.

Homebuyers still want those old-fashioned pieces of paper. They like something tangible to hold, share, and sometimes, even hang on the refrigerator.

Printed marketing materials fall into one of the three primary areas: mortgage marketing direct mail, mortgage flyers, and mortgage closing gifts.

Direct mail materials are still one of the top methods for engaging with your audience. However, the static, non-interactive mortgage marketing flyers and brochures your parents received in the mail are a thing of the past. Innovative mortgage CRM systems like Surefire by Top of Mind take print based marketing to a whole new level within the mortgage industry.

This Article Covers:

In the old days (not so many years ago, actually), printed rate sheets were the go-to marketing tool for mortgage originators. Loan officers often spent their Friday afternoons delivering printed rate sheets to real estate offices, arming agents with timely rate news and lending options before their weekend showings. With a little luck and a lot of perseverance, their information would land in the hands of qualified buyers, and (hopefully) inquiries would turn into applications the following Monday.

Printed documents still play an important role in mortgage marketing efforts. Lucky for today’s loan officers, the emergence of digital mortgage marketing tools has made weekly delivery of updated rate sheets to local real estate offices a thing of the past. A rate sheet can find its way to an email inbox much faster than into the agent’s mail cubby at the office. Even better, a continually updated landing page can offer agents current rates with a simple tap on the phone screen.

It’s important, however, that mortgage marketers don’t get so swept up in the quick solutions and shiny presentations of online mortgage marketing that they forget the basics of long ago. Maybe there isn’t a pressing need to get into a real estate agent’s office each week. But there’s still value in offering a piece of paper or mailed postcard to a potential partner — especially if it sends them to different web-based lead generators that help fill your mortgage pipeline.

Open house flyers and educational flyers may seem like yesterday’s news, but they still perform vital functions for building a successful mortgage business.

Effective open house flyers have these important components:

Educational flyers are an often overlooked lifeline for mortgage brokers and bankers. In addition to the marketing and co-branding opportunities they offer, informational mortgage flyers can also save loan officers precious time. Rather than taking phone calls to field the same questions over and over from multiple borrowers, loan officers can share written explanations quickly and easily.

Options for educational flyers are endless. Common topic categories include:

To be most effective, mortgage marketing flyers should be informative, eye-catching and easy to read. The best mortgage CRM systems provide editable flyers with modern designs marketers can adjust to their company style. The graphics and the marketing content—the actual words—will be provided. The ability to edit is vital so mortgage companies can ensure the language is compliant and aligns with their own processes.

Ideally, a mortgage marketing system will offer the ability to share educational flyers digitally or through print. While online mortgage marketing flyers are vital in today’s digital world, printed versions still have their place including:

See Why Surefire is the #1 CRM Chosen by Industry Professionals!Request a Demo

Sure, we can throw a bunch of numbers around that show great results of direct mail efforts, but your business is unique. Want to know if your efforts are worth the investment you’re making into direct mail? We recommend:

Most mortgage marketing professionals find that it is best practice to integrate their marketing flyers with other digital marketing initiatives, including downloadable content, live calls, or email workflows the ensures that their mortgage marketing flyers provide an immediate engagement when their prospective borrowers

Of course, the borrower is not the only consumer of mortgage marketing flyers. Referral partners such as real estate agents receive massive value from co-marketing materials, educational flyers about lending, and other flyers and digital interactives they can use to secure loans for their buyers. With a mortgage marketing engine like Surefire, loan officers can easily generate custom co-branded presentation books to help them secure the referrals from partners required to fill their lead pipeline.

Like printed flyers, postal mail may seem out of style these days. But with all the digital messages constantly screaming at consumers, a warm greeting or even a clever solicitation in the mailbox can offer a nice break.

And if a trusted advisor sends just the right resource at the right time? Even better!

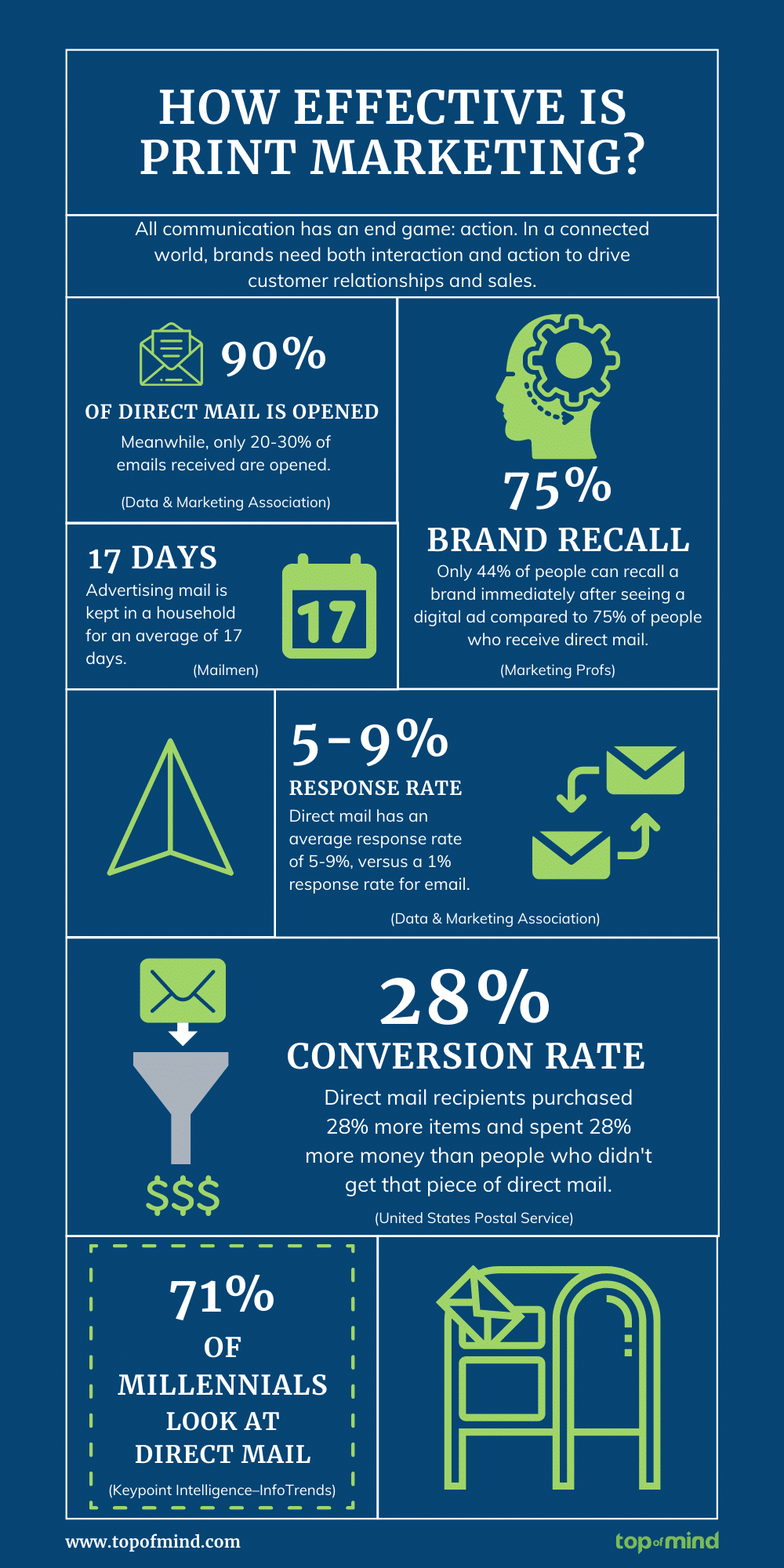

Direct mail is more memorable than digital. Immediately after receiving a direct mail piece, 75% of recipients can name the brand that sent it. Conversely, only 44% can immediately recall the sender of a digital ad. And direct mail captures an average response rate between 5% and 9%, versus only 1% of emails.

A compilation of direct mail statistics from various sources showed 41% of Americans look forward to checking their mail every day, including respondents of all ages. Furthermore, about 90% of direct mail pieces get opened, versus 20-30% of emails.

The fact is people like getting mail, and they’re more likely to recall the brand that sent it. There’s less clutter in a mailbox than in an email inbox or on social channels. And with less competition for attention, mailed messages are easier to focus on, comprehend and remember.

Mortgage marketing postcards stand out over other kinds of mail. According to the Data & Marketing Association, postcards get a higher response rate at 4.25%, while direct-mailed letter-sized envelopes garner a 3.5% response rate. Plus, they’re cheaper to mail than letters.

Mortgage marketers find it easy to make an impact with a bold, colorful image on the postcard face and targeted messaging on the back. And recipients can view and comprehend them quickly and conveniently. A letter in an envelope may require the recipient to put other things down to open and review. They are not as likely to go to the trouble and receive the full message if it looks like just another marketing piece.

Postcards, especially large ones with colorful images, stand out from the crowd. Even if mailboxes are not as full as they once were, mail pieces may still find some competition. An odd-sized, sturdy card is less likely to get lost in the mix.

Images that spark curiosity are even more likely to grab attention. Unexpected images that go beyond a generic home or people signing mortgage papers will likely lead to unexpected and memorable text.

Finally, because of the limited space, marketers are required to create succinct messaging for postcards. This practice makes it easier for recipients to grasp the message and understand the needed response quickly.

It’s always a good time to send mail. Whether the goal is to earn repeat business, engage new borrowers, or build referral partner relationships, mailed pieces can help. Here are some ideas to consider.

Direct mail marketing can be automated with a mortgage CRM platform. Just as with digital marketing, mailed mortgage marketing materials can be deployed automatically through a mortgage CRM. There are three primary ways:

Want to See First Hand What Surefire by Top of Mind Can Do? Schedule The Demo!

The loan origination process is complicated, long, and at times quite stressful. It’s important for loan officers to remember that each closing is something that they should celebrate with their customers.

Closing gifts are a great way for mortgage professionals to commemorate the moment and create clients for life through branded content.

Branded gifts or gadgets that have a long lifespan of use in the kitchen or office are some of the best closing gifts for loan officers to give to their borrowers. Using these closing gifts helps to remind your borrowers of the lender responsible for their current home and can leave a positive impression when it comes time to refinance.

The mortgage industry brings its own challenges and opportunities to any type of marketing. The primary unique concern is mortgage marketing compliance. All printed materials must allow space for appropriate licensing and disclaimers to appear conspicuously, per guidelines. Ideally, the mortgage marketing platform will allow standard formatting to assure required statements appear consistently on every piece.

The best mortgage CRMs will allow users to edit existing content or to create marketing content from scratch. Importantly, they’ll also enable managers or administrators to review and approve edits or new pieces created by loan officers or other team members to assure compliance and company branding.

Printed mortgage materials are often co-branded with referral partners. Templates need to allow space to promote two professionals, usually with contact information, logo, and photo for each. It’s helpful if the mortgage CRM system used to create the pieces addresses value sharing, per RESPA requirements.

Luckily Surefire CRM and marketing automation platform by Top of Mind Network brings the tools, industry specialization and experience to make implementation easy and effective. Our team would love to give you a tour!

Get instant access to tried-and-true mortgage marketing strategies and guides with Mortgage Marketing University.

See how Surefire effortlessly develops content tailored to your brand. Sign up for a free look book today.

You have what it takes to be a top mortgage lender and Surefire has what it takes to get you there. Learn How!

Networking events are an important way to begin and enhance working relationships with both potential clients and referral partners.

Ad conversion rate measurement helps LOs gauge the effectiveness of their marketing spend. Surefire mortgage CRM can boost those metrics.

Credit union marketing strategies can benefit significantly if marketers utilize content designed from the start to foster engagement.