What technologies can improve the consumer-direct process?

Communication is key to closing more loans. This is why many consumer-direct lenders choose the Surefire CRM tool from leading mortgage industry provider Black Knight over other mortgage CRMs. Centralized marketing, eye-catching paid search ads and content for messages direct from the lender to the consumer allow for a seamless stream of communication for any number of lending scenarios.

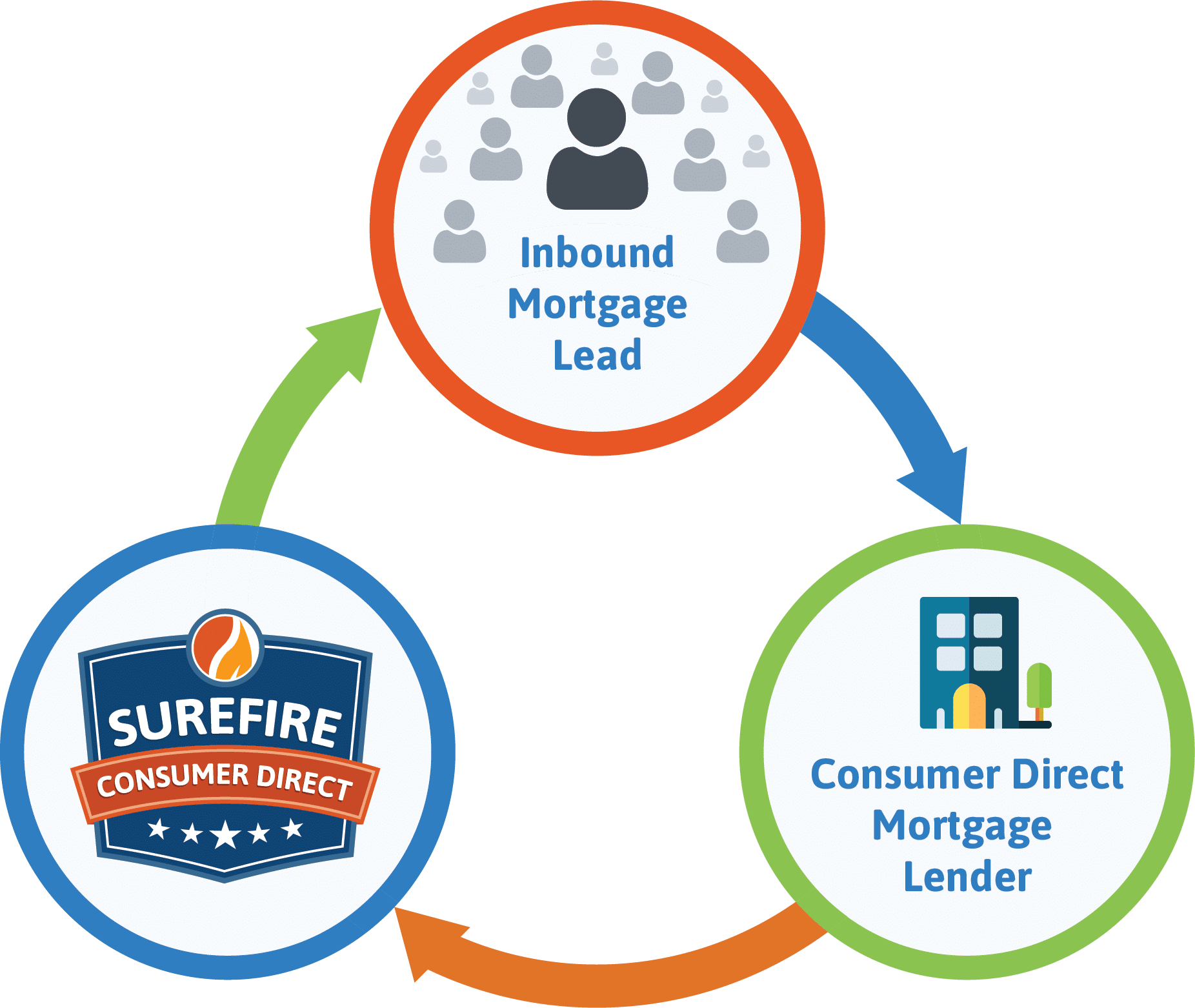

This, paired with lead distribution algorithms and open data interfaces to connect with inbound round-robin calling systems offered by Surefire, helps customer inquiries and new leads to be given the same level of customer service provided by a retail lender.

Round-robin calling refers to automated inbound call routing software that directs each inbound call from a new lead or inquiry to a different user’s phone. Round-robin calling is an excellent method for consumer-direct lenders to distribute leads fairly among their loan officers because it ensures everyone is assigned an equal number of leads and inquiries. Once everyone on the round robin calling list receives a call from a new lead, the round robin is repeated. With this call routing technique, consumer-direct lenders and their mortgage advisors can worry less about the logistics of lead distribution and focus more time on converting inquiries into loans.

Since many of today’s borrowers prefer to research mortgage options and communicate digitally, it’s important to choose a mortgage CRM that meets borrowers where they are. Usually, that’s on their mobile device.

Surefire’s Power Messaging SMS texting solution helps consumer-direct lenders automate and streamline the loan origination process by automatically triggering loan updates and reminders – from inquiry to closing and beyond. The messages are personalized and actionable, contain lenders’ unique branding, and can feature eye-catching imagery and video marketing content that keeps borrowers informed and engaged.

Surefire’s Power Messaging is one of the few SMS texting technologies that can help organizations scale the reach of those behind the loan process so that loan officers can meaningfully engage consumers while growing their sales pipelines and maintaining mortgage marketing compliance.

Additionally, while a strong SEO strategy can help make sure prospects find lender websites, a powerfully integrated mortgage CRM can mean the difference between site views and full-fledged leads. When a prospect completes a loan inquiry form on a lender’s website, that information is automatically populated into Surefire CRM’s omni-channel mortgage marketing database. In this way, consumer-direct lenders’ SEO strategy can directly create leads that build out their pipeline and CRM database.

Technologies that permission access for referral partners also help ensure that real estate agents can monitor the loan origination process and assist with keeping their buyer’s transaction on track to close.